It’s no secret that college is expensive. Today students face high costs of tuition, housing, meal plans, and other university fees. However, these upfront costs don’t include the money students spend to have the idolized “college experience.”

From dining out with friends, grabbing a coffee, doing laundry, or taking day/weekend trips off campus, the college student experience is, to put it bluntly—expensive.

After hearing from several college students about their spending habits and “fun” expenses, high school students should start saving now unless they have an overseas Swiss trust fund.

The amount of financial aid a student receives from FAFSA, institutional aid, or local scholarships/grants also plays a big role in the net price of schools. Students should stay adamant about

The major spending categories for most college students are food, transportation, and recreation.

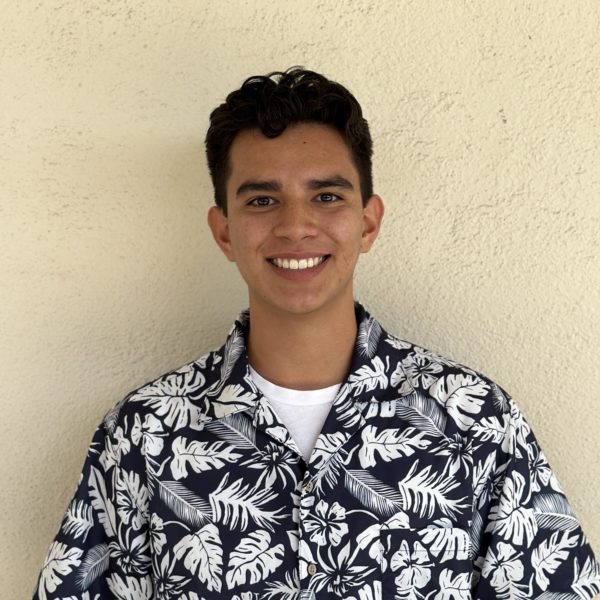

“Don’t spend your money! Most people including me will justify spending small amounts of money each day, but doing this adds up quickly. I think I’ve spent $200 or $300 each quarter on things I didn’t need,” UCLA freshman Cristian Munoz said.

Munoz noted that some clubs have a one-time membership fee of $20-$50 at UCLA. These clubs will also sometimes take day trips ranging from $20 to $100, however despite the cost, Munoz stated that the experiences, connections, and networking these clubs provide are worth the price.

“I ended up spending way more money on zip cars than I expected. With college, I found that money is time and time is money. You got to choose if you want to take the trolley or bus for cheap but it takes longer, or pay like $25 for zip car to get someplace quickly,” SDSU freshman Aranza Sanchez said.

SDSU freshmen who live on campus can’t have cars without a valid exemption, like having an off-campus job or extenuating circumstances. Freshmen should expect to spend a good chunk of money on transportation like rideshare apps (Uber, Lyft, Zipcar), and public transport unless they can catch rides with upperclassmen or are willing to walk.

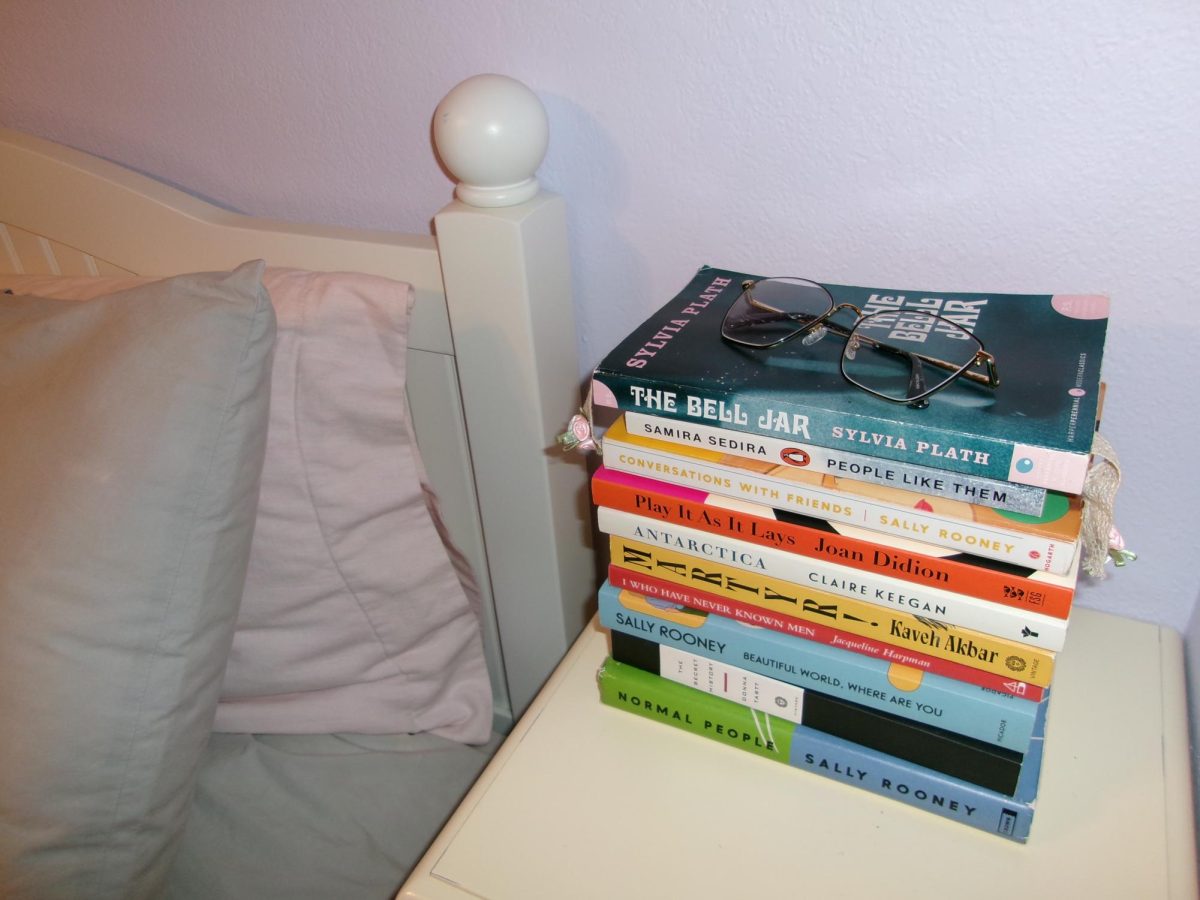

Everyone has things they like to splurge their money on, whether it’s something niche like Blundstone boots or something common like triple-shot espresso lattes, sometimes spending money on yourself is the therapy students need during college.

Nathaniel Kotnik, Georgia Tech University freshman and Air Force ROTC recipient recommends buying a Keurig or some other drip coffee maker to save on coffee spending, which can add up quickly. If your college has a strong football program, also expect to spend some money dressing up for tailgates or buying student football tickets (which are typically discounted).

“I splurge on buying things from Costco, like a $150 knee-high speaker, and crepes from the community market,” Kotnik said.

College is full of expected and unexpected expenses. However, some take students by surprise eating away at their budgets. The overall trend from college students is to save when possible, but still spend to have a great time.

College is a transformative time for many people, from the new experiences students undergo to the invaluable connections and career advancement opportunities, the cost is justifiable for many students. However, students should try to prepare for direct expenses like housing and indirect expenses like transportation.