Gamestock: A Story of Wall Street

How the greenhorn investors of Reddit’s “wallstreetbets” community turned Wall Street on its head

Photo of the GameStop logo.

The Internet, for better or worse, gives anyone with a computer the power to affect the world on a small or massive scale. Though this ability has been present since the dawn of the digital age, the advent of social media over the past decade has raised its potential to incredible heights; if a single person can change history through their actions on the Internet, what could an entire community accomplish? It’s something of a scary thought. Fortunately for us, it’s no easy task to change the world by any means, making these sorts of occurrences rare – as well as making them very shocking when they actually happen.

The most recent earth-shaking event to be attributed to random people on the Internet occurred in January of this year: in a classic underdog story of cinematic proportions, a group of like-minded individuals, united under the common goal of causing a bit of mischief, were able to reckon with the gods of the American stock market.

It began on Reddit’s “r/wallstreetbets” board, an Internet community centered on, as the title implies, Wall Street bets. Under the alias “DeepF***ingValue”, Reddit user Keith Gill, a Massachusetts financial analyst, encouraged his online compatriots to purchase high amounts of stock in the company Gamestop, an American video game and consumer electronics retailer. Once a staple of shopping malls across the United States, Gamestop has fallen behind in recent years as a consequence of the rise of Amazon Prime and online shopping. As a result, stocks in Gamestop have been on the decline for a number of years, a trend which led Gill to purchase over $50,000 worth of call options (a sort of “contract” that gives its buyer the right, though not the obligation, to purchase an asset at a specific price in a specific period of time) in the summer of 2019.

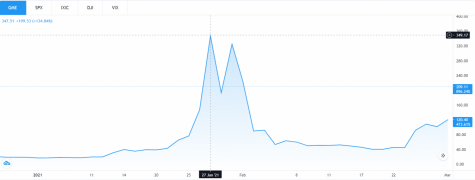

By January 22nd, 2021, Gill’s position had climbed to a value of $48 million. This

led the users of r/wallstreetbets to purchase high amounts of Gamestop stock on the same day, initiating what is known in the stock market as a “short squeeze” – an event in which the price of an asset, typically one that is experiencing a low supply and a high demand, dramatically increases in price over a short period of time, forcing short-sellers, traders who had stood to profit off of the asset’s failure, to buy the now-ridiculously overpriced stock in order to prevent an even greater loss. In the span of a week, Gamestop’s stock price increased by an insane 1,500 percent, with tens of millions of its shares being traded every day. Many Reddit users who had participated in the short squeeze were able to amass four and five-digit fortunes within a matter of days.

Unfortunately, the community’s success came at the expense of the starving, penniless hedge funds sitting upon their gilded thrones on the peaks of Wall Street. Many hedge funds felt the reverberations of the short squeeze, but none tasted bitter defeat more than Melvin Capital, an investment fund that had previously been trying to “short” (profit off of an asset’s failure by driving its stock as low as possible) Gamestop, which suffered a staggering 53 percent loss in its investments by January 31st. Though a number of other hedge funds such as Citadel LLC and Point72 Asset Management invested billions of dollars into Melvin Capital following its losses, their combined efforts weren’t enough to allow Melvin Capital to totally break even from the short squeeze.

It didn’t take long for the Gamestop stock surge to gain worldwide attention. Major media outlets began covering the story days after the company’s prices began to climb. Public attention grew even further when, on January 27th, Gamestop was acknowledged in a Biden administration daily briefing by White House Press Secretary Jen Psaki, who reported that Biden’s economic team was monitoring the situation “very closely”. As it happens, Keith Gill, along with Melvin Capital CEO Gabriel Plotkin and Reddit co-founder Steve Huffman, was summoned to court in mid-February to testify about his role in the short squeeze before the House Committee on Financial Services. These ongoing proceedings aren’t focused on the actions of r/wallstreetbets, but rather the questionable decisions made by a popular stock trading app known as Robinhood; the service, which many people utilized to make their stock market transactions, locked its users out of purchasing and selling stocks in Gamestop. Dozens of lawsuits were filed by disgruntled investors, and the case made its way to the congressional courtroom, where it is currently waiting for a verdict that, depending on its outcome, may outweigh the significance of the events which started it…

Has the Gamestop stock surge officially “ended”? It’s hard to say. Prices in Gamestop’s assets began to plummet to a measly $50 at the beginning of February, though a recent surge on March 12th saw the company’s prices soar over $200. However, the (mis?)adventures of r/wallstreetbets are undeniably far from over; the community is larger than ever, with a combined user base of over 9.5 million investors, and recent activity on the board suggests that similar short squeezes may be initiated with other short-stocked companies like AMC Entertainment and Blackberry. Whether you view these people as crusaders fighting against the tyranny of Wall Street, or morons meddling with powers beyond their comprehension, there’s no denying that their almost profound impact on the United States economy makes for very interesting (and entertaining) news.

Adam Mercer is a senior at Arroyo Grande High School and a second-year reporter for the Eagle Times. He likes to read, write, listen to music, watch movies,...